Are you looking to find out what currency is used in Ireland today in 2021? This will be dependant on where in Ireland you are looking to visit or send money too and it’s very important to get it right! Read on to find out more…

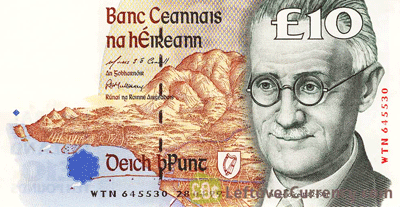

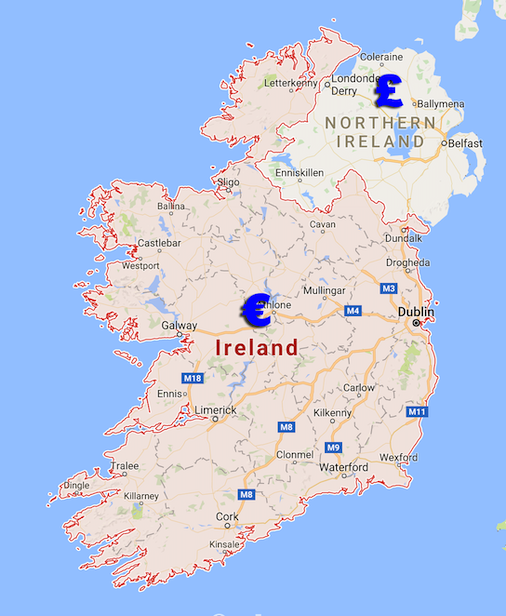

To begin with, it is important to know that there are two currencies used in Ireland. If you are in Dublin or Belfast it is important that you understand that. The two currencies are the Euro, which is used in the Republic of Ireland (or southern Ireland as its sometimes called), and the Sterling Pound is used in Northern Ireland. However, it is important that you note that the Sterling Pound wasn’t the main currency in Ireland before the Euro. Let’s review the currencies in their individual locations in Ireland. Before the Euro the was introduced on January 1st 1999 the Irish Pound (Irish: Punt Éireannach) was used.

Money Used In The Republic

The Euro currency is used in the Republic of Ireland as the official currency. Unlike in other parts of Europe, in Ireland, one Euro is equivalent to 100 cents. However, this was not the currency before when the main currency was the Punt. In 2002, the Euro began circulating in the Republic of Ireland, hence making it an official currency. The Euro currency only has 2 Euros as coins, the rest of the coins are in cents.

Northern Ireland Currency

On the other hand, the currency in Northern Ireland is the Sterling Pound so for instance if you were in Belfast you would need GPB pounds to buy things. In Northern Ireland, 1 Sterling pound is equivalent to 100 pence. Like the Euro currency, there only have two main coins that are 1 and 2 pounds, the rest are pence.

Where Can you Change the Currency

In case, you move from Northern Ireland to the Republic of Ireland or you arrive either place and you do not have their respective currency, you have no reason to worry. This is because it is easy to exchange your currency for the respective currency even in airports. Furthermore, you may also do this at any bank or ATM machine.

Fortunately, there are many ATMs within the country, hence, it is very hard for you to lack a place to exchange your currency. However, it is important that you note that banks may not open as early as you expect. They open at 9:30am and close at 4:30pm Monday through Friday except on Thursday. Notably, Thursdays are unique days within the country, hence banks close at 5:00pm rather than at 4:30pm like on other days.

ATMs, Credit Cards, and Debit Cards

Before travelling to Ireland, it is important that you first visit your bank and check whether your card has been activated. This activation allows you to use the card while in Ireland failure to which you might get stranded in Ireland.

However, in cases where your ATM card does not have a chip, you have no reason to worry. This is so because you will be able to withdraw some limited amount of money. If by any case you need to do a large transaction, you may need to give your ID so that the bank may be able to identify you as the owner of the ATM.

Fortunately, Visa’s and Mastercard’s are used in most countries all over the world. Therefore, you may use this to pay for almost anything while in Ireland. However, cards that are designed for specific countries such as American Express, Canada Diners, and Discover are not accepted in Ireland.

Using cash in Ireland

Notably, very few retailers accept cash. However, very few retailers will also accept credit cards, especially if the payment is low. For example, most retailers may not accept to take credit cards to pay for a product or service below 10 euros. In spite of this, they may choose to accept Irish debit cards. This may happen because of their acquiring bank charges when it comes to credit cards.

When it comes to calculating the amount of cash you will get after converting your currency, all you need to do is visit a website. The currency calculator Ireland system will allow you to be able to know the exact amount of money you will receive after conversion.

Shopping In Ireland With Your Credit And Debit Card

When traveling around the world, one of the most convenient ways to shop is with the use of a credit card or a debit card. Paying in cash or traveller’s cheques allow you to manage your budget. However, carrying it around could pose some risk and inconvenience even if you’re in Ireland which is one of the safest and most beautiful places on earth.

Credit Cards

A credit card makes it possible for you to pay for your purchase through instalment. Even with interest factored in, it will give you enough time to settle the payment in full. In Ireland, almost all establishments recognize credit cards and accept them as payment. If you are using Visa, American Express, Mastercard or Eurocard, you shouldn’t have any problem as these are the most widely used.

The case may not be the same if you have a Discover or a Diners Club card as these are not popular. You may have difficulty finding establishments that accept either of these two cards, most especially Discover.

Debit Card

A debit card enables you to withdraw cash from any Automated Teller Machine (ATM). You can withdraw only the amount of money you need to stay on your budget. Another advantage is that the exchange rate at an ATM is usually more “friendly” compared to a bank.

You will not have any difficulty looking for an ATM in Ireland. It will not matter if your card is VISA or Mastercard. The ATMs in Ireland can accommodate them. However, if you want to be 100%, clarify the acceptability of your card with the issuing bank.

Clarification On Debit Card Transaction Charges

You should know that tourists are exempted from a 12c charge called the stamp duty whenever you use your debit card to withdraw from an ATM. This charge came to effect last January 2016 and only applies to Irish citizens.

Many Irish locals are not aware of the nature of the stamp duty charge. It was implemented at the same time the Euro 2.50 annual stamp duty charge applied on ATM cards and the Euro 5 duty on both debit and ATM cards were discontinued. There is annual cap equivalent to Euro 2.50 and Euro 5 for ATM and debit cards respectively. The change was implemented as a way to discourage people from using cash. It will take 42 total transactions in an ATM to hit the Euro 5 annual duty charge. The government will still charge you Euro 5 if your withdrawals exceed 42 transactions.

If you have fewer than 41 withdrawals within a calendar year, the total amount of charges you will pay would be smaller compared to the former stamp duty fees. Note: The charges imposed by the government on both ATM and debit cards are not the same as the fees charged by the banks whenever you transact with a machine. There have been instances when the bank will levy a transaction fee that is more than 35c.

Things to Note

In spite of all this, it is important to note that higher denomination notes are not usually accepted in small retail outlets. However, what happens if you need to buy something that costs that much? I would recommend that you go to those retail shops with lower denominations that may amount to the amount you need for your transaction.

In addition, I would recommend that you carry some cash with you since you may need to buy one or two things in the shops especially in rural areas.